One of the tenets of Shorepine Wealth Management is that “costs and taxes are some of the largest detriments to positive outcomes…we look to minimize these at all times.”

That is why one of the first exercises we employ when we meet a new potential client is to determine what their “all-in” cost of investing is. By “all-in” we mean the cost of their advisor fees, plus the cost of their investment fees (for example: mutual fund fees) plus any other costs they may not be aware of (account maintenance fees, etc..).

It is staggering what some investors are paying for their financial plans. Even more staggering is how MUCH MORE money they would have in retirement if they diligently reduced these fees.

Sometimes it makes sense to pay more for a good fund. Other times it does not.

Take a look at the results below and decide for yourself…

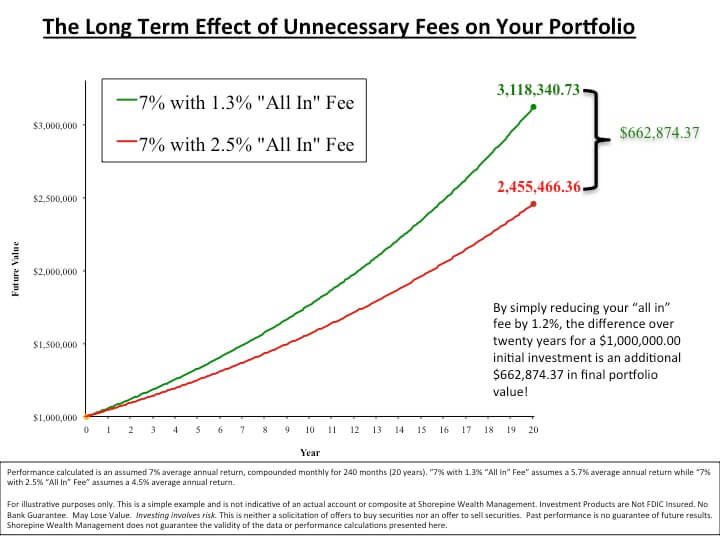

For both scenarios we assume the investor started with $1,000,000 and the “market” grew by 7% per year, compounded monthly.

Advisor #1 (red line) is charging their client 1.5% and placing their investments in funds with a net average fee of 1%. The “all-in” cost to the investor is 2.5%.

Advisor #2 (green line) is charging their client 1% and placing their investments in funds with a net average fee of 0.30%. The “all-in” cost to the investor is 1.3%.

The difference over 20 years is an additional $662,874 in the account of the investor who chose advisor #2.

This is a staggering amount of additional money in retirement. Money for healthcare, money for your heirs.

Do you know what your “all-in” fee is?

Contact Shorepine Wealth Management and we can help you find out!