What Did We See?

- U.S. Large Cap stocks, or the S&P 500 index, were down about 3.3% in Q3.

- The developed market of Japan was up about 2.5%.

- Europe and the U.K. were down about 3.4% and up about 1.9% respectively.

- Emerging Markets and Asia (Ex-Japan) were down about 3% each.

- Global fixed income returns ended the quarter from up about 1.5% (Euro High Yield) to down about 5% (Global Inflation Linked)

Where Do We Stand?

- The very strong 2023 market rally faded in Q3.

- Valuations are still elevated versus historic averages in some pockets of the market while earnings continue to remain at risk.

- The markets will likely remain choppy from here as major events unfold Globally and in the U.S.

- We remain in a position to weather the volatility with positions in Gold and Cash while taking advantage of opportunities when they present themselves.

The third quarter of 2023 proved to be a bit of a reality check for investors as both Bond and Stock markets fell. Economic data was a major driver of the moves as growth deteriorated and headwinds to further growth took center stage. We now enter the “muddy” portion of the global rate hiking cycle. A time period when clarity on what the future may hold is at its lowest. Will the Fed stop raising rates? When? How long will they hold them at restrictive levels? What will the Fiscal situation be in the coming months? Can the US sustain a “soft landing” scenario? Many questions arise and the answers may come soon or could come much longer than desired to arrive.

Govern Yourself

For several years now the “powers that be” have been asking the economy and markets to better govern themselves. By that we mean the global powers want inflation to tame and the markets and economy to better reflect these desires. They have been clear they will keep interest rates “higher for longer” to achieve their goals. The powers want the markets (and asset values) to reflect their restrictive stance. They want the economy to slow and hence, prices to subside. They want all this regardless of a recession. In fact, they seem to be ok with a mild recession at worst. It is a tricky game and for several quarters prior to Q3 they have not been getting everything they wanted. The markets had remained resilient and inflation remained higher than their desired levels. Has that all changed?

Monetary

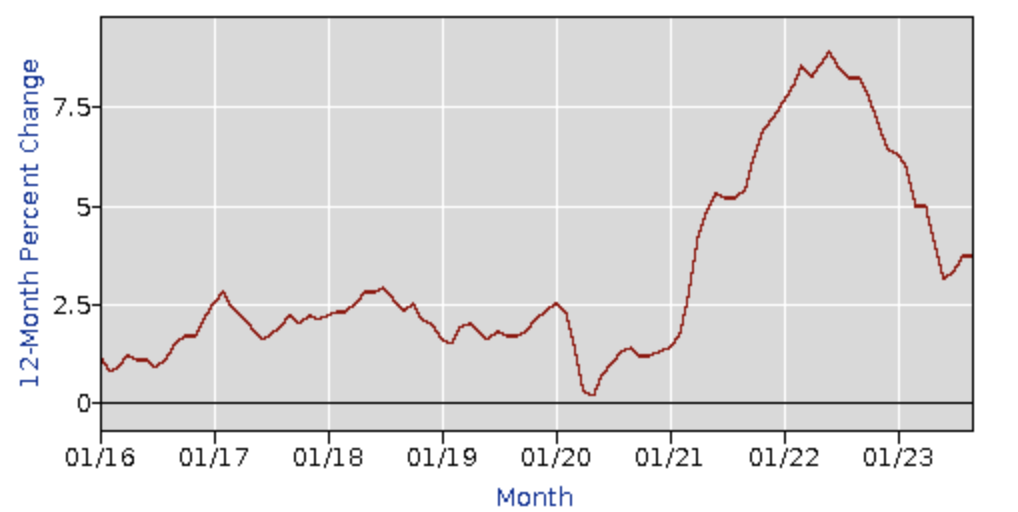

The Federal Reserve is steadfast in their belief that restrictive policy will eventually tame inflation. It has worked, for the most part. Inflation has subsided from the pandemic driven June 2022 high of 9.1% to a recent 3.7% in September of 2023.

However, that 3.7% is still almost double the Fed’s stated objective of 2%. The Fed will keep rates at the current target rate of 5.25% – 5.5% (or dare I say higher?) until they see a sustainable Inflation number closer to 2%. What will that do to the markets and growth?

Fiscal

On the Fiscal front the Administration is proud of the work we have done. Moving from more than 9% inflation to less than 4% is a success story. The lawmakers role now is to not do anything to drive the train off the tracks while the Monetary authorities complete the job. And as is typical in our political environment, they are doing the opposite.

The government narrowly avoided a complete government shutdown at the beginning of the 4th quarter. They did this by “kicking the can down the road” with a 45 day reprieve funding bill. That means that on November 15th we are back in the same debate. Unfortunately, this date comes AFTER the Federal Reserve’s next meeting on November 1. We can expect The Federal Reserve to hold rates at current levels. We will also see a new Speaker of the House during this period so expect more uncertainty around that.

Growth

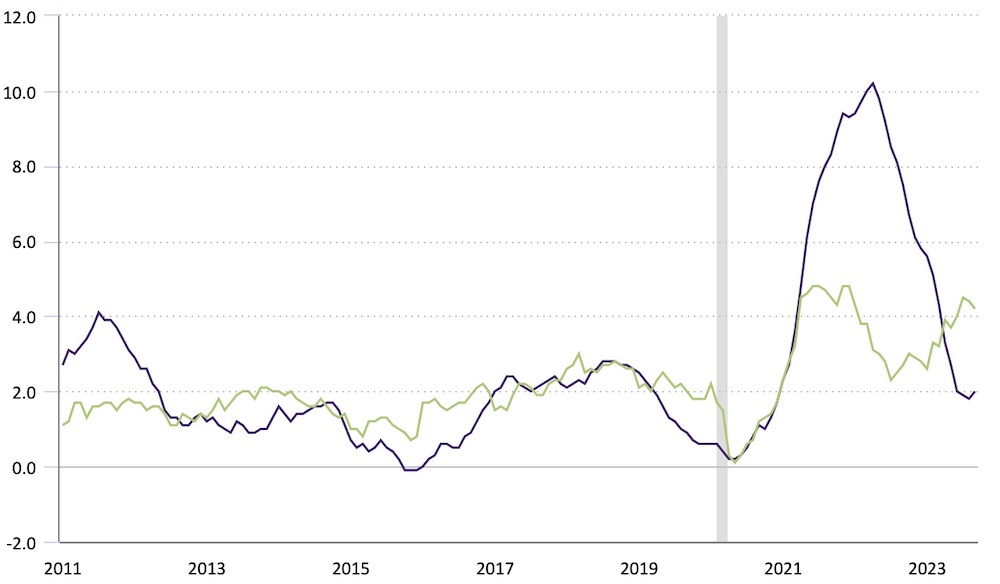

Our economy runs on growth. It drives the economy and markets react in anticipation of that growth (or lack thereof). During Q3 we finally saw services (green line) starting to slow as manufacturing (purple line) remains weak.

In prior tightening cycles the Federal Reserve could depend upon Goods prices (manufacturing) to tame and hence, drive broader inflation numbers lower. Not this time. This time they will need a moderation in Services to achieve their 2% target. Services drive upwards of 60% of our economy, while manufacturing makes up about 30%. If they need Services to slow, we can expect a large portion of the US Economy to feel that pain. Bad for jobs. At the same time, they will not have the favor of moderating energy prices as global unrest and other factors are expected to keep energy prices inflated. Quite a conundrum.

Global

Global unrest will also play a major factor going forward. From the ongoing war in Ukraine to the recent events in the Middle East. Although it did not happen during the quarter, the events unfolding in the Middle East will likely have major implications for the region and the world. The tinderbox has been ignited and the uncertainty around the end result of these actions are just that, uncertainty. Markets hate uncertainty and I would expect that to play out in the markets, whether it be from continuing higher oil prices or actual market shocks going forward.

Whatever your personal views may be, the innocent loss of life and extreme barbarism we have seen is not good for anyone and should not be a part of any ongoing conflict. Wars are fought by soldiers, not innocent people living their lives.

Where to?

All of this paints a picture of higher volatility, higher uncertainty and many unknowns. With the aforementioned “higher for longer” narrative on the interest rate cycle, bonds continue to reflect the uncertainty of that policy. Q3 saw one of the larger bond meltdowns in recent history. With the resetting of expectations are we now in a place where bonds can retake their position as the ballast in investor’s portfolios? I would expect that to be the case.

There are positives, for sure. Large Cap companies have stronger balance sheets than they did before prior recessions. Thus, they can better whether the storm should any recession be longer or deeper than expected. Inventories are now at reasonable levels after the post-pandemic rebuild. Inventories at equilibrium levels will help provide stability in future quarters. Lastly, the U.S. consumer has yet to see significant job losses which may help bolster consumer spending going forward.

Stocks remain resilient but for how long? With all of the expected events we now have in front of us I cannot see a world where one should allocate all their capital to stocks. Hence, we continue to have higher than normal cash allocations in portfolios. These cash allocations are in short term Treasuries where they can earn more than regular cash but can be seen as relatively “safe” from the shocks the future may bring.

If you have any questions or have experienced any changes in your financial situation please do not hesitate to Contact Me.

We appreciate you being a part of the Shorepine Wealth Management family!

Investment Products are Not FDIC Insured. No Bank Guarantee. May Lose Value. Investing involves risk. All written content on this website is for information purposes only. Opinions expressed herein are solely those of Shorepine Wealth Management, unless otherwise specifically cited. This is neither a solicitation of offers to buy securities nor an offer to sell securities. Past performance is no guarantee of future results. Material shown here is believed to be from reliable sources however, no representations are made by our firm as to another parties’ accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. Shorepine Wealth Management, LLC is a registered investment adviser offering advisory services in the State of California and in other jurisdictions where registered or exempted.