[sonaar_audioplayer albums=”1549″][/sonaar_audioplayer]

What Did We See?

- Global markets declined in August only to rebound nicely in early September.

- The major markets of Japan, Europe, the UK and the U.S, were able to eek out minor gains for the quarter.

- Emerging Markets and Asia (Ex-Japan) achieved negative returns for the quarter.

- Global fixed income returns have been mostly positive in response to central bank easing actions.

- I cannot fail to see that the risk of a global recession is steadily rising as the data have recently indicated.

Where Do We Stand?

- We are at the stage of the cycle where heightened volatility becomes the norm.

- I continue to believe in the wealth creation engine that is global equities but have deemed it important to tread lightly.

- I remain in a position of avoiding overweights to equities and overweights to riskier positions.

- Until I see more clarity on the issues of tariffs, the UK/Brexit, geopolitical issues and the true strength of the U.S. economy, we remain in a protective posture for our clients.

- I continue to rebalance your accounts accordingly and have been impressed with the power of the asset allocation strategies we employ.

While the end of the summer was a difficult one for most global equities, the month of September saw global markets rebound from their summer lows. Enough so that the major markets of Japan, Europe, the UK and the U.S, were able to eek out minor gains for the quarter. While positive equity returns are always a good thing, one cannot fail to see that the risk of a global recession is steadily rising. The tariff wars are ongoing and at times intensifying while global politics remain at heightened levels. The Federal Reserve is not expected to make further policy changes in 2019, while corporations are beginning to struggle with slowing profits growth. CEO’s will likely need to respond with a reduction in capital expenditures, a cutting of jobs or both. In fact, we have already seen some companies begin this process. Lastly, the IPO market in the U.S., a true indicator of healthy markets, has faltered significantly as of late.

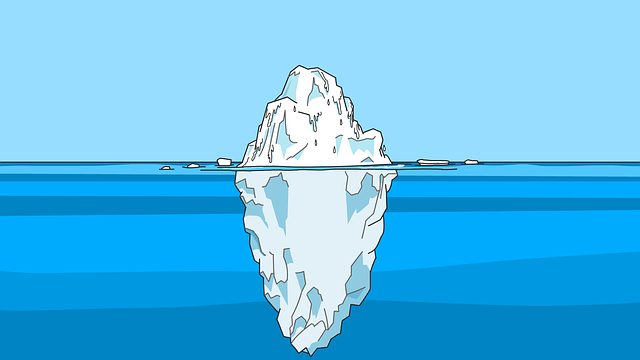

Late in the Cycle

We are very late in the business cycle. Profits have peaked and have failed to breach the levels last seen in late 2014. In fact, estimates now show negative to sub-5% income growth for the next few quarters. As my readers know, the yield curve signaled this slowdown a few months ago. Recent data show that U.S factory activity has shrunk to its lowest levels since 2009, a result of the ongoing tariff wars. The U.S. manufacturing index is flashing a recession warning and recently posted it’s lowest reading since June of 2009. Not to be outdone, the services index also slowed significantly in September.

The result of all this weakness is that we are now in a global central bank easing cycle. Normally, this is the right thing to do at this stage. However, prior misguided actions have left the banks with little to no powder left. The U.S. is already at historically low rates with not a lot of room to cut more should things get really bad. Even worse, Europe recently cut their rates into negative territory while restarting quantitative easing in a misguided effort to spur inflation. Some fiscal stimulus from the U.S. or Europe could help but the timing of such or the ability of economies around the world to afford it is questionable at best. For example, the US enacted a major tax cut in 2017 that did little to improve long term growth while increasing the deficit by almost $2 Trillion. Is the political will there to do more if needed? One could argue no.

Resilience or Insanity?

The market does not seem to care about all that. In the US, a second interest rate cut from the US Federal Reserve, continued job growth (albeit slowing) and the prospect of a U.S.- China trade agreement pushed markets higher. The bulls are hyper-focused on the health of the credit markets, the seemingly willingness of the U.S. consumer to spend into debt and labor markets that are strong. I would argue these are three things that can change quickly.

Underneath the surface, everything that has led the markets for the past two years has lagged through the September recovery. Typical rotations occur all the time in healthy markets. What has done well sometimes falters and what has done poorly sometimes recovers. That is why we often rebalance opportunistically. And then there are the rotations that occur when markets shift. Oftentimes the “typical” rotations can be temporary in nature as the “animal spirits” of the markets work through emotional reactions to recent news. The news gets digested and the prior leadership regains their positions at the top. However, the rotation that began in late August has remained in place through considerable domestic issues and geopolitical developments. It is a “stickier” rotation than normal. Much of the past leaders have not regained their perches. Whether or not this rotation signifies a true market shift is yet to be determined. This analyst thinks there’s something there.

Global Issues

The rest of the world continues to struggle with their own issues of slowing economic results. In the UK, the prospect of a never-ending Brexit adventure continued. The friction between the prime minister, Boris Johnson, and parliament has reached epic proportions. The Brexit uncertainly has forced the Bank of England to remain on hold in their policy decisions. In Japan the government has just hiked consumption taxes in the face of a slowing manufacturing sector and decreased confidence levels. In China, industrial production growth has been cut almost in half, retail sales growth has slowed significantly and further tariffs are due to be put in place by the end of the year. With the coming U.S. election cycle next year it is doubtful that the Chinese will concede to U.S. demands until clarity on the next president is achieved. If I was in their shoes I probably would wait.

Where do we Stand at Shorepine Wealth Management?

We are at a stage in the global economic cycle where unpredictable events can quickly change investor sentiments. A fine example of this occurred in the downturn in August (U.S. equities down more than 6% in 6 trading sessions) and the subsequent rebound in early September (U.S. equities up almost 6% in 12 trading sessions). Many of these events seem to be binary in nature, making their effects even harder to predict. Thus, it only makes sense to tread lightly. I have never lost my belief in the wealth creation engine that is the U.S. economy. I also firmly believe that one of the best ways to benefit from that is to be in investor in equities. There are opportunities around the world to participate in the ongoing human desire to better themselves and their condition.

The Need For Clarity

However, when dealing with decisions around savings and retirements it is always best to err on the side of caution. Thus, I remain in a position of avoiding overweights to equities and riskier positions. Until I see more clarity on the issues of tariffs, the UK and Brexit, geopolitical issues (especially in the Middle East) and the true strength of the U.S. economy we remain in a protective posture for our clients. This entails our prior work on de-risking portfolios and slightly increasing our cash-like holdings. We have not increased the levels of protection we have employed but are prepared to do so should conditions cited above warrant.

If you have any questions or have experienced any changes in your financial situation please do not hesitate to Contact Me.

We appreciate your being a part of the Shorepine Wealth Management family and wish you all the best!

Investment Products are Not FDIC Insured. No Bank Guarantee. May Lose Value. Investing involves risk. All written content on this website is for information purposes only. Opinions expressed herein are solely those of Shorepine Wealth Management, unless otherwise specifically cited. This is neither a solicitation of offers to buy securities nor an offer to sell securities. Past performance is no guarantee of future results. Material shown here is believed to be from reliable sources however, no representations are made by our firm as to another parties’ accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. Shorepine Wealth Management, LLC is a registered investment adviser offering advisory services in the State of California and in other jurisdictions where registered or exempted.