What Did We See?

- U.S. Large Cap stocks, or the S&P 500 index, were up about 8% in Q4, down about 18% in 2022.

- The developed market of Japan was up about 3%.

- Europe and the U.K. were up about 11% and 9% respectively.

- Emerging Markets and Asia (Ex-Japan) were up about 10% and 11%.

- Global fixed income returns ended the quarter mixed to mostly up.

Where Do We Stand?

- The market experienced a relief rally in Q4 that helped damper a poor year.

- Valuations have moved to below historic averages in most markets but earnings remain at risk.

- The severity of any future corrections will be dictated by the actions of the Fed and the severity/length of the coming recession.

- We remain in a position to weather the volatility with positions in Gold and Cash while taking advantage of opportunities as they present themselves.

The fourth quarter of 2022 brought some relief to what was a very difficult year for markets around the world. In 2022, the war in Ukraine and the incessant battle against inflation drove almost all markets, bond and equity alike, to lower levels. This fight against inflation resulted in considerably higher interest rates around the world. Those higher interest rates, in turn, effected almost all markets from Equities to Real Estate to Bonds. In normal environments one can expect to experience a bumpy ride in stocks. However, the unusually large sell-off in bonds that coincided with the equity sell-off really left nowhere to hide for investors during 2022.

Phase Out – Inflation & The Fed

Undesirable markets come in phases. The first phase of this market was the peaking of inflation. The second phase was the reaction of the Fed (higher rates) and markets (lower prices). The next phase is the recession. Each phase happens slowly, then all at once. Phase one saw a denial of the effects of high inflation. This slowed the market’s reaction until inflation actually caused problems. Then it seemed like all anyone could talk about was inflation. Phase two saw the consensus believe the Fed wasn’t going to raise rates as much. This slowed the market’s reaction until The Fed signaled and did in fact keep raising rates. The next phase is going to be the actual recession, whereby the real economy feels the effect. Again, there will be denial and a slowing of reactions until the data shows the economy has faltered. As is usually the case, when it feels like it won’t end, it’ll already be over.

Phase In – Real Estate & Spending

Higher interest rates, after having effected stocks and bond markets, will now continue to filter to other areas and cause the recession the Federal Reserve wants & needs. Real Estate has already begun to feel the pain and will likely feel more. Currently, the 30 year mortgage is pushing 6% or more, up from 3% less than a year ago(?). At the same time median house prices have risen from about $320K in 2019 to about $400K today, a rise of about 25%. Let that sink in. Mortgage rates have more than doubled while home prices are still 25% above the same price levels when mortgage rates where half of what they are now. Certainly, the housing market has cooled. Prices are down about 7% since the high in June, the peak of the selling season. However, a 20% further drop would only get the market back to 2019 levels. Furthermore, the number of homes sold is now down about 30% year-over-year. Expect more cooling.

Remember though, the markets are anticipatory devices. You can’t wait for the tide to turn because it’s already coming in by the time you realize it.

Real Estate is The Economy

These things take time. There are two types of home sellers. There are the sellers that need to sell (moving, divorce, lost job) and the ones that want to sell. The ones that need to sell will be forced to accept lower prices. The ones wanting to sell may just decide not to. So there is a natural underpinning to home prices (as supply dries up). But remember, this effects everything. Less equity in homes means less people initiating home improvement projects, less people buying big screen TV’s, less people buying cars. And all the people attached to those industries (contractors, salespeople, retail establishments) will feel the pinch. It reverberates through the economy. THAT is the pain we have not yet fully endured.

Spending is The Economy

The spending that is due to slow is the true driver of revenues and profits for corporate America. However, there is less money to go around because we are now in a world where discretionary income is under attack. Because of inflation, real incomes have not grown and in most cases have shrunk. Credit has become tighter while debt levels have risen. Wealth and accessible equity (see Real Estate comments above) has shrunk. While humans tend to be slow to react, at some point spending will slow more than it already has. Retail sales have moderated but not enough. Faced with historically difficult comparisons (year over year), I would expect profits to decelerate through at least the first half of this year, maybe longer.

Throwing Darts

The reasonable path of least resistance is still down, for now. At least until markets have more clarity on when the Fed will stop raising rates and at what levels. Until the data begins to earnestly show the economy has cooled. Until market valuations are more in line with expected profit levels going forward.

The first two quarters of 2023 will likely see the wash-out of all I have cited above. Does that mean equities lose another 20% from here? Not likely, but still within the realm of possibilities. Alternatively, there is also the possibility it happens quickly and the markets react favorably during the year.

At the end of the year the S&P 500 sat at around 3,840. Wall Street strategists have targeted the end of 2023 at an average of about 4,000, a gain of around 4%. The range of estimates is between 3,400 (down 11%) and 4,500 (up 17%!). To put it mildly, it’s anyone’s guess. Thus, the prudent action is to remain invested with some of your portfolio, act opportunistically when you can and keep an eye on defense. Clients at Shorepine Wealth are currently invested in this manner.

A Note: Is 60/40 Dead?

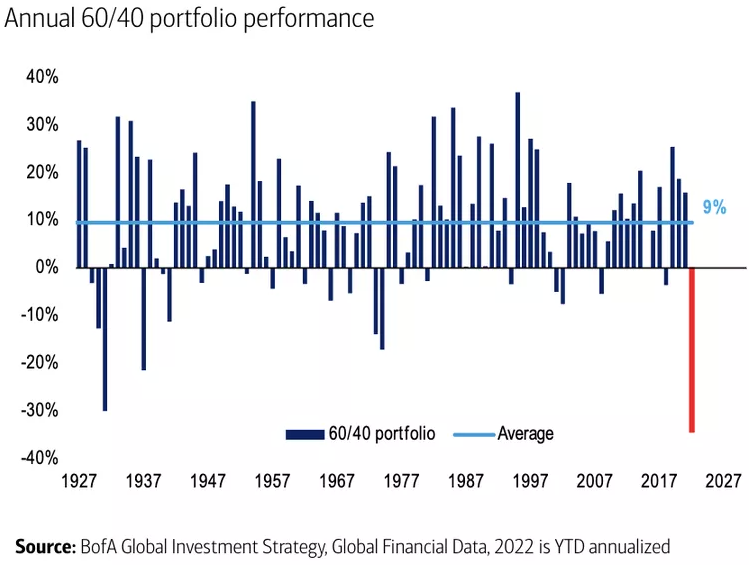

Last year was one of the worst years on record for the standard 60/40 portfolio (60% Equities, 40% Fixed Income). While there have been years where the portfolio had two or more negative years in a row that has been rare and has not occurred often. In fact, it only has happened four times since 1927. On the chart below I would focus on what has happened AFTER periods of negative returns. In cases where negative returns were extreme (i.e.: more than 20%), the following years tended to be just as extreme to the upside. While there is no guarantee, the probabilities are favorable looking out one, two or three years from now. The lesson? When the markets get short (volatile), it’s best to get longer in your time horizon.

If you have any questions or have experienced any changes in your financial situation please do not hesitate to Contact Me.

We appreciate you being a part of the Shorepine Wealth Management family!

Investment Products are Not FDIC Insured. No Bank Guarantee. May Lose Value. Investing involves risk. All written content on this website is for information purposes only. Opinions expressed herein are solely those of Shorepine Wealth Management, unless otherwise specifically cited. This is neither a solicitation of offers to buy securities nor an offer to sell securities. Past performance is no guarantee of future results. Material shown here is believed to be from reliable sources however, no representations are made by our firm as to another parties’ accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. Shorepine Wealth Management, LLC is a registered investment adviser offering advisory services in the State of California and in other jurisdictions where registered or exempted.