What Did We See?

- U.S. Large Cap stocks, or the S&P 500 index, were down about 4.6% in Q4.

- The developed market of Japan was down about 1%.

- Europe and the U.K. were down about 8% and up 0.5% respectively.

- Emerging Markets and Asia (Ex-Japan) were down more than 7%.

- Global fixed income returns ended the quarter down between 4% and 9%.

Where Do We Stand?

- The market began the year with broadly negative returns in Q1.

- Valuations have moderated a bit from lofty levels but earnings remain at risk.

- The correction we have been anticipating has come, the severity is unknown.

- We remain in a position to weather the volatility while taking advantage of opportunities as they present themselves.

After a stellar 2021 the markets endured a rather difficult first quarter. Full scale war in Ukraine and the expectation for ever-increasing rate hikes in the U.S. helped push both bonds and stocks lower. The uncertainty of it all weighed on sentiment throughout the quarter and likely left more questions unanswered. Consumer sentiment turned sour in the face of inflationary pressures that seem to go unabated. While the U.S. markets were able to recover a bit in March, much of the rest of the world remained mired in negative returns. As the negative forces weighing on markets continue to search for resolution, the constructive approach is to avoid panic selling, stay diversified and look to reposition portfolios more towards longer term investment themes. Opportunities are borne out of volatile times.

Markets at War

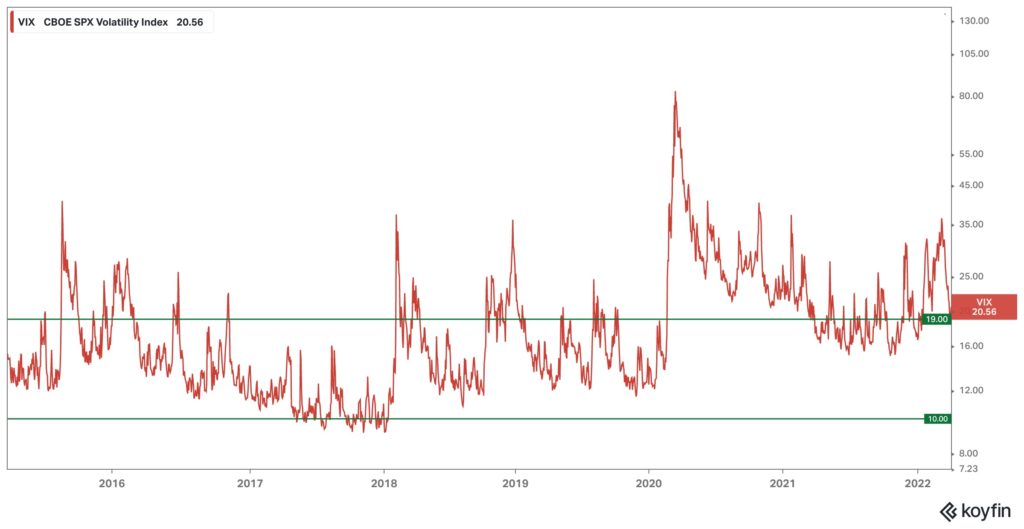

As war rages in Ukraine there is a different war raging in the markets. Bulls versus bears. Inflation versus The Fed. The result of these internal market battles is higher volatility. During the first quarter the index that tracks volatility ranged between 16 and about 36 (See chart below). For the entirety of last year the average was about 20. Somewhere between 10 and 19 (Green lines in chart) is what one could consider an “investable” market. (i.e.: a market where the probability to achieve returns is higher than the probability to not). The average of the volatility index during the first quarter was about 26. Not a great market to make money in. Remember though, single indicators are not to be traded on. Just like a mosaic, one tile does not make the whole picture.

Not so Safe Havens

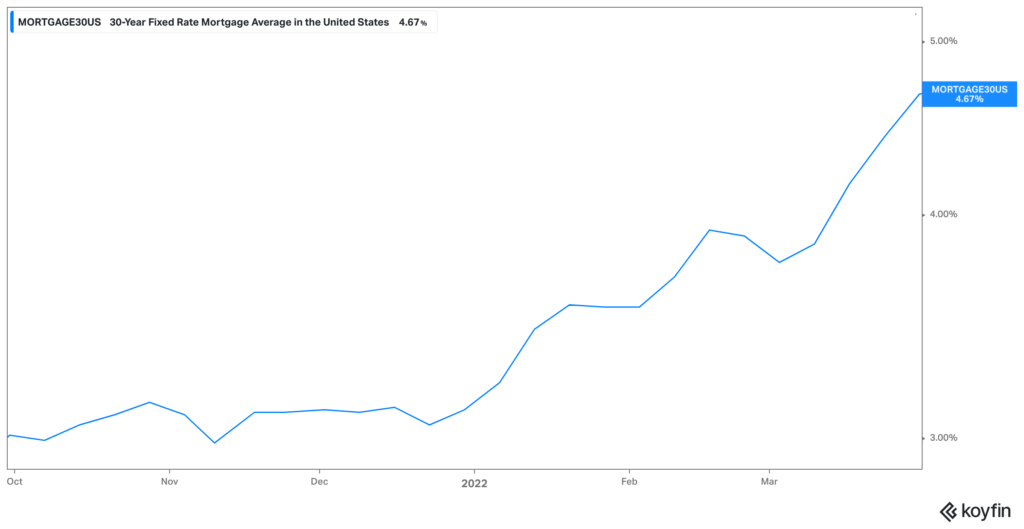

A confluence of events has led both the bond and equity markets to react in a negative manner. Normally, in a stable inflation and rate environment, when stocks go down bonds tend to be stable to higher. Thus, historically bonds will act as a “safe haven” during soft equity markets. Not this time. With the expectation for up to 7 Federal Reserve rate hikes this year, bonds had one of their worst quarters in over 40 years. Bonds tend to react negatively when rates are moving higher. This is due to the inverse relationship between bond prices and the yields on bonds. When yields go up, bond prices move lower. Yields are certainly going up. The thirty year mortgage rate had one of its largest moves in recent memory moving from about 3% to almost 5% in one quarter! (See chart below)

Inversion

More troubling has been the reaction of a device known as the yield curve. The yield curve is a graphical representation of all of the yields on U.S. Treasury bonds by varying maturities. When shorter term treasuries (i.e.: 2-Year Treasuries) have a higher yield than longer term Treasuries (i.e.: 10-Year Treasuries) the yield curve is said to be “inverted”. This example is also known as the 2/10 yield curve.

Our friends at TD Ameritrade posted a nice description of the yield curve that can be found here.

Historically this event has been a harbinger of a coming recession in the U.S. economy. In fact, the 2/10 yield curve has inverted 28 times since 1900 and 22 of those times the economy went into a recession. There is a lag between when a yield curve inverts and the recession begins. That lag tends to be somewhere between 6 to 18 months. There even was one instance when the lag was three years.

So the timing of recessions is very very difficult to predict, even if you were sure there was a recession coming. Furthermore, an important distinction is the severity of the yield curve inversion. At this point, the inversion we are experiencing is very mild. While technically inverted, not a lot of actual points on the yield curve are inverted. Most of the “mild” inversions have not historically led to a recession. Granted, all of the more severe yield curve inversions began as mild ones.

Reversion

Because of the aforementioned lag and the lack of severity in the inversion, the worst thing an investor could do is panic in the face of one indicator. The last four times the yield curve inverted (and a recession came), the S&P 500 was up an average of almost 29% between the time the curve inverted and the time the recession began. Again, timing recessions is a very difficult thing to do. What if it never comes and you are not invested?

Lastly, because recessions are determined by backwards looking data points, there is also a lag between when recessions actually begin and when the indicators tell us we are in a recession. By the time you are certain you are in a recession, you may be coming out of it. The average post-WWII recession has lasted less than a year. Not a long time in the realm of the average investor’s investing time horizon.

Can it be different this time?

Due to all the factors discussed above, the world is stuck in a quagmire. Oil volatility is having a global effect upon consumers and inflationary pressures continue to drain pocketbooks. The war has dampened global sentiment as well. Lastly, the pandemic is still active and raging in parts of the world. Europe is tied to Russia via its dependency on natural gas while the UK is destined to feel the global effects of a slowing world. Not a pretty picture for the time being.

However, of note is that geopolitical crises tend to have shorter term impacts than we expect. While the market effects of a war tend to have extremely negative market responses, they also tend to work themselves out of it in relatively short time periods. I would expect this event to fall somewhere in that historical retinue. Remember, Russia is really just Europe’s gas station. There is a group of thugs running the station but the station makes up less than 4% of global GDP.

Conclusion

Although the difficulties with the markets could continue for a time, all hope is not lost. The economic slowdown we are experiencing will do much to combat inflation while many positives can come out of the period we find ourselves in. This war has again awoken the world to the folly of countries being economically tied to oil regimes. There does not exist many oil regimes that are also good global actors. This will likely move many governments to accelerate their moves to sustainable, local sources of energy. Possibly, the reduction of oil revenues will instigate some changes in behaviors (or regimes)? One can only hope.

As we sit today, client portfolios all have higher than normal cash levels. As well, a protective position in Gold was purchased in January. While these tactical decisions will not mitigate all of the effect of a drawdown in markets, they will help us protect the downside. This benefits us when the opportunity exists to take advantage of whatever the markets have on sale in the future. Always look forward.

If you have any questions or have experienced any changes in your financial situation please do not hesitate to Contact Me.

We appreciate you being a part of the Shorepine Wealth Management family!

Investment Products are Not FDIC Insured. No Bank Guarantee. May Lose Value. Investing involves risk. All written content on this website is for information purposes only. Opinions expressed herein are solely those of Shorepine Wealth Management, unless otherwise specifically cited. This is neither a solicitation of offers to buy securities nor an offer to sell securities. Past performance is no guarantee of future results. Material shown here is believed to be from reliable sources however, no representations are made by our firm as to another parties’ accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. Shorepine Wealth Management, LLC is a registered investment adviser offering advisory services in the State of California and in other jurisdictions where registered or exempted.