What Did We See?

- U.S. Large Cap stocks, or the S&P 500 index, were up about 4.3% in Q2.

- The developed market of Japan was up about 1.7%.

- Europe and the U.K. were up about 0.6% and up about 3.7% respectively.

- Emerging Markets and Asia (Ex-Japan) were up about 5.1% and up about 7.3% respectively.

- Global fixed income returns ended the quarter mostly negative from -2.7% (Japan) to flat (U.S.).

Where Do We Stand?

- The market rally continued in 2024 in spite of a reduced number of expected rate cuts.

- Valuations remain elevated versus historic averages yet earnings have shown some strength to support this.

- The markets will likely shift focus from the Federal Reserve to the coming Election cycle.

- We remain in a position to weather any volatility with positions in Gold and Cash while looking to be more active in opportunities when they present themselves.

In the face of continued reductions of the number of rate cuts coming in 2024, the US market showed remarkable resilience in the second quarter. Ongoing optimism around the health of the U.S. Economy supported risk assets once again to the tune of a 4.3% return in the S&P 500 for Q2. The index now sits more than 15% higher than the beginning of the year. With corporate investments around Artificial Intelligence surging, labor markets tightening and the U.S. consumer continuing to spend, there seems to be little that can stop the current theme of U.S. expansion.

Over the past few months, inflation and geopolitics have taken a back seat to “good enough” corporate earnings, A.I. driven investment and continued expectations of lower interest rates on the horizon. We remain vigilant that any small trigger (can you say “Election Season”?) may pull negative sentiment to the forefront and quickly change attitudes around the U.S. and the Global economy.

Resilience in Growth

The current economic expansion, which began in mid 2020, is now moving past its fourth year anniversary. Driven by fits and starts, this expansion has certainly seen its share of volatility in the last 4 years and it continues to remain a volatile expansion. For example, Real GDP fell from 4.9% annualized in Q3 of 2023 to just 1.3% in Q1 of 2024. Some of this volatility can be attributed to the measurement of exports and inventories, often difficult items to measure. However, the truth remains, this expansion, while strong, has seen its fair share of unpredictability. A possible explanation for this has been the driving force of consumer spending.

While at times fickle, the US consumer has remained strong even as pandemic savings have dwindled. Looking forward, the question remains whether or not wage growth and wealth gains can push the consumer to maintain such high levels of spending. On the corporate side, investment spending has also remained resilient in the face of high interest rates and credit issues borne out of the mini banking crisis in 2023.

Resilience in Labor

The US unemployment rate has remained at or below 4% for the last 10 quarters. That is the longest it has been this low since the late 60’s. Payrolls continue to climb upwards, gaining almost 3 Million over the past year alone. At the same time labor force participation continues to rise surely helped by a surge in new migrants.

Yet, in spite of the surge in new labor force participants, wage growth remains positive, albeit slowing from 4.6 in April of 2023 to 4.1% this year. The net result is the labor markets remain above pre-pandemic levels and look to continue at trend levels after moderating a bit.

The Great Divergence

Economies around the world are beginning to diverge from each other. The US is once again acting as the global growth engine that could, while Europe and China seem to be struggling. India has been a surprise driver of global growth while Japan continues to shows signs of economic tailwinds. In a post-Covid world we are seeing the effects of insular policies around the pandemic continue to play out.

For example. in the U.S. there is a decided push to “onshore” manufacturing and supply chains as much as possible. When the pandemic hit in early 2022 many companies found out just how much they were beholden to a global supply chain. Remember all those new cars sitting in a lot because they were missing one semiconductor chip? They don’t want to be caught again. The result will be a world where cross border growth comes more from finished products. The days of a global supply chain may be limited.

The Big Monkey Wrenches

Monkey Wrench #1 – Consumer Spending

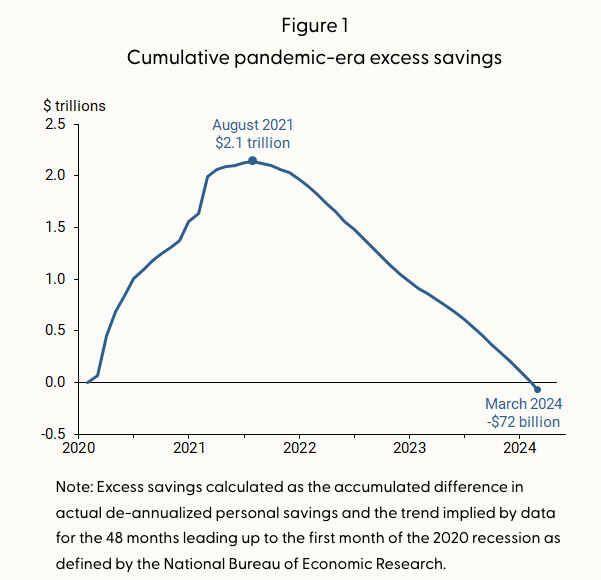

Following the onset of the pandemic recession, households in the U.S. rapidly accumulated excess savings. This was largely due to financial support doled out by the U.S. Government at the same time consumer spending saw a steep decline. It was hard to spend money if you couldn’t travel or go to entertainment venues (movies, bars, restaurants, etc..). These excess savings were estimated to have peaked at around $2.1 Trillion in August of 2021. They have been steadily declining ever since as consumers retuned to “normal life” and spent down their savings. As you can see below, these excess savings are now all completely depleted. This is where your “strong U.S. Consumer” has come from.

Certainly there are other places where consumers can spend from. Gains in equities and other assets have been strong. They can be sold to raise spending cash. Also, credit card debt has been rising and could rise further. However, undoubtedly there is one or two less cylinders firing in the engine that is the U.S. consumer.

Monkey Wrench #2 – Elections have Consequences

The other large monkey wrench is the U.S. election cycle. Beginning with the debates that have already begun, the U.S. is going into talks period that typically feels very negative. There are periods of volatility around any election and this one will no doubt have its moments. Whether or not those moments go beyond the typical volatility is yet to be seen.

Be prepared for anything and remember the U.S. stock markets have dealt with far worse than a robust and volatile presidential election. Whether it is a “Blue” win or a “Red” win, each result will have benefits for parts of the economy.

Monkey Wrench #3 – Resilience in Inflation

On a more negative front, inflation has also remained resilient. Energy prices recently have rebounded, shelter inflation declines have slowed and things like auto insurance are seeing double digit increases over the past year. After having hit about 9% in the summer of 2022, we are now at a much more reasonable 3.5%.

Yet the headline number has remained at about 3.5% for almost a year now. It is taking much longer than expected to come back down to the Federal Reserve’s desired 2% target. As time moves on the populace is continuing to struggle with higher prices for almost anything and everything. It feels unsustainable for most consumers.

The Challenge Now

As we sit and watch the events unfolding around us the challenge remains to control our emotions. It is easy to project a future world where one party or another takes control of the country and implements policies detrimental to portfolios. Whether it be via tax policies or trade actions, parties in power can oftentimes disrupt industries. Beware the “ides of November”.

Any of the three “monkey wrenches” above could have a negative effect on portfolios at any time. Because of this, Shorepine Wealth maintains some defensive qualities to portfolios that will help assuage volatility in the next few quarters. The challenge will be to allow these volatile periods to play out without doing long term damage to portfolios.

If you have any questions or have experienced any changes in your financial situation please do not hesitate to Contact Me.

We appreciate you being a part of the Shorepine Wealth Management family!

Investment Products are Not FDIC Insured. No Bank Guarantee. May Lose Value. Investing involves risk. All written content on this website is for information purposes only. Opinions expressed herein are solely those of Shorepine Wealth Management, unless otherwise specifically cited. This is neither a solicitation of offers to buy securities nor an offer to sell securities. Past performance is no guarantee of future results. Material shown here is believed to be from reliable sources however, no representations are made by our firm as to another parties’ accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. Shorepine Wealth Management, LLC is a registered investment adviser offering advisory services in the State of California and in other jurisdictions where registered or exempted.