What Did We See?

- U.S. Large Cap stocks, or the S&P 500 index, were down about 16% in Q2.

- The developed market of Japan was down almost 4%.

- Europe and the U.K. were down about 10% and 5% respectively.

- Emerging Markets and Asia (Ex-Japan) were down almost 9%.

- Global fixed income returns ended the quarter down between 3% and 14%.

Where Do We Stand?

- The market accelerated broadly to the downside in Q2.

- Valuations have become historically cheaper in most markets but earnings remain at risk.

- The severity of any future corrections will be dictated by inflation and the actions of the Fed.

- We remain in a position to weather the volatility while taking advantage of opportunities as they present themselves.

The markets had one of their worst quarters of returns in recent history. There’s no easy way around it. Nearly all asset classes suffered losses, leaving almost no place to hide during the quarter and the first half of this year. The headwinds that drove the market malaise during the quarter remain in place. Extremely high levels of inflation, slowing economies around the world, rising interest rates, lack of clarity on Fed policy and the war in Ukraine to name the primary ones. Until these headwinds begin to abate, the markets will continue to act with uncertainty and hence, volatility. However, not all is lost. We have been here before and will undoubtedly be here again. The most important thing now is to not make mistakes navigating through the storm. We need to ensure our portfolios are fit enough to pick up speed when the storm is over.

Corporate Weakness

The number of stocks in the Russell 3000 (broad market index) trading below their cash levels have reached an all time high. Towards the end of the quarter, 167 companies of the 3000 had market capitalizations below their own cash holdings. The previous record was 165 that was achieved in February of 2009. This is what happens when you come out of a free cash environment. Corporate managers often do not save for a rainy day and the rain is here. Expect to see bankruptcies. Interestingly, this is all happening faster than it has during previous recessions. Extreme market efficiency in a world where data and information is ubiquitous has clearly accelerated the anticipatory nature of our markets.

More Hikes

In January, Fed Chairman Powell held a press conference to announce the beginning of rate hikes to quell inflation. After the announcement, the markets anticipated about 4 rate hikes to occur during 2022. As we’ve moved through time that number of anticipated rate hikes for this year has increased steadily. At one point it was as high as 11 hikes!

As we sit today the market is still anticipating about 7 rate hikes. We have gotten 3 hikes thus far. 25 basis points in March, 50 basis points in May and 75 basis points in June. The June hike was the largest rate hike since 1994. Have no doubt, the Fed is going to kill inflation regardless of what it does to the economy or markets. Expect another 75 basis points or more in July. Markets have moved aggressively to price in these rate hikes and the potential for a hard landing (i.e.: deep recession). The real question now is whether or not the coming recession is more severe than markets have anticipated.

Earnings

All eyes will turn to quarterly earnings reports slated to start in early July. If earnings hold up well we will be given some respite from the valuation destruction we have seen. A decent enough earnings season could be a sign of strength. More importantly, “good enough” earnings may be enough to signal to the markets that the recession we are expecting has already been “priced in”. This is one of the risks investors are now faced with. If the markets have in fact priced in the coming recession then the markets should at some point begin to recover. In which case, trying to time the last leg of any market downturns is an exercise in futility. However, if earnings are weak and the coming recession is worse than markets are anticipating, there is still more downside ahead of us.

Global Malaise

Around the world we are seeing disparate economic results. In Europe, higher energy prices and lower trade has risen the specter of stagflation. In Japan, we are seeing lower growth driving lower levels of inflation. Coupled with a lower Yen, we could see a potential intervention there by the Bank of Japan. China’s Zero Covid policy will likely slow growth in the country, but the opportunity for accommodative fiscal and monetary policy may soften the impact. Lastly, emerging markets are seeing divergences in economic performance as Covid, higher energy prices and political risks weigh on their economies at differing levels. Overall, the era of global economies sharing in global growth has ended.

Silver Linings

As previously mentioned, not all is lost. Valuations outside of the U.S. are now well below their average for the past 30 plus years. In the U.S., some parts of the markets are considered cheap while other parts still remain elevated. (Hence the comments on a bit more pain to go.)

Another positive is that we are not going to see another credit crisis like the one we experienced in 2008. More than 95% of Americans acted wisely and locked down long term fixed rate mortgages over the past few years. Coming into 2008 only 80% had fixed rate mortgages. Furthermore, sub-prime lending is nowhere near where it was then. Lastly, our banking system is much better capitalized than it was then. This all will help avoid the major problems previous recessions have caused such as lack of market functioning or credit implosions. While the market is not doing what we would like right now, it is functioning well.

Time is your friend

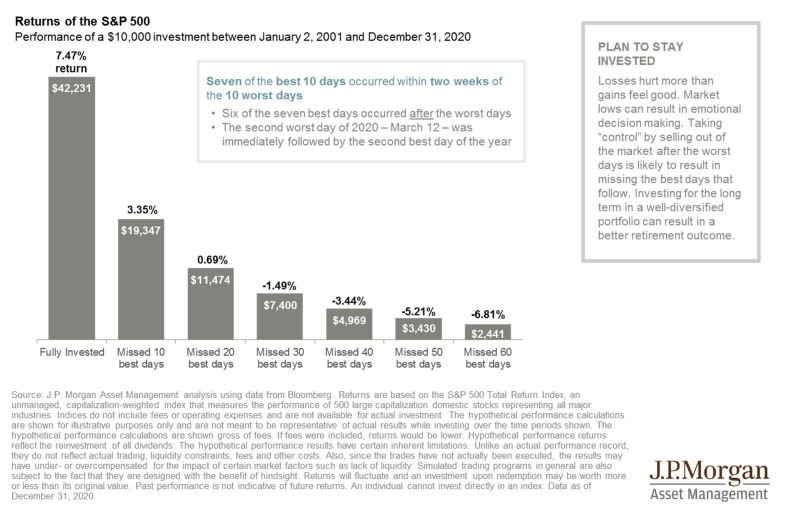

The most successful course of action proven over time has been to not do a lot during these periods. I know that sounds counter intuitive. However, history and the data suggests that missing large up days in the markets is most damaging to long term returns. A previous blog post Your Bear Market Toolkit is a great post to review right now.

Also, one can simply note the below chart from our friends at JP Morgan:

This chart depicts the average annual returns of the S&P 500 from 2001 through 2020, a twenty year period. Note during this time there were three major recessions (2001, 2008 & 2020), terrorist attacks, wars and the like. Yet, if one was to remain fully invested in the market during all this time, they achieved an average annual return of almost 7.5%. If that same person missed the 10 best days in the market, their average annual returns (over the entire 20 year period) got cut to 3.35%. That is a massive haircut! Most importantly, note that 7 of the 10 best days occurred within 2 weeks of the worst 10 days.

Concluding

For sure, there are risks remaining in this market. The Fed could way overshoot what is necessary in regards to interest rate increases. This would drive us into a deeper recession than normal. The average recession in the post WWII period has lasted only about 11 months. That is not a long time. However, should the Fed not manage this environment well, we could be in for a longer recession than normal.

This is why our accounts have higher than normal cash allocations and positions in Gold. This should help mitigate our losses while affording us the opportunity to “catch” most of those large up days in the market that are sure to come. As always, remember it is your overriding asset allocation that will dictate your experience over the past 6 months and the months ahead of us. The more time you have available to you, the higher your risk will likely feel during these environments.

A longer term perspective and patience will serve us all well for the reminder of 2022.

If you have any questions or have experienced any changes in your financial situation please do not hesitate to Contact Me.

We appreciate you being a part of the Shorepine Wealth Management family!

Investment Products are Not FDIC Insured. No Bank Guarantee. May Lose Value. Investing involves risk. All written content on this website is for information purposes only. Opinions expressed herein are solely those of Shorepine Wealth Management, unless otherwise specifically cited. This is neither a solicitation of offers to buy securities nor an offer to sell securities. Past performance is no guarantee of future results. Material shown here is believed to be from reliable sources however, no representations are made by our firm as to another parties’ accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. Shorepine Wealth Management, LLC is a registered investment adviser offering advisory services in the State of California and in other jurisdictions where registered or exempted.