What Did We See?

- U.S. Large Cap stocks, or the S&P 500 index, were up about 7.5% in Q1.

- The developed market of Japan was up about 7%.

- Europe and the U.K. were up about 10% and 3% respectively.

- Emerging Markets and Asia (Ex-Japan) were up about 4% each.

- Global fixed income returns ended the quarter up from about 2% to more than 5%

Where Do We Stand?

- The market experienced a strong bear market rally in Q1.

- Valuations have come back to elevated versus historic averages but earnings remain at risk.

- The markets will likely remain choppy from here as rallies validate bulls and pullbacks validate bears.

- We remain in a position to weather the volatility with positions in Gold and Cash while taking advantage of opportunities as they present themselves.

Both equity and bond markets saw strong returns to start the year as economic data suggested that the US economy continued to grow in the first quarter. However, overshadowing the positive developments were events in the banking sector that saw several very large banks fail. Although inflation has begun to tame, there are still effectively high levels of inflation running rampant throughout the economy.

Furthermore, the inflation data that the markets have reacted to have been suspect. To wit, the data is showing a taming of inflation as energy prices eased while Main Street continues to struggle with ever higher prices. Much of the rally of Q1 was predicated on this easing of inflation, giving the Fed enough wiggle room to pause the tightening campaign. This expectation, in turn, pushed bond yields lower and equities higher.

The expectations of a looser Fed are just wishes in our opinion. Certainly, we are closer to the end of this tightening cycle than the beginning. However, we are only beginning to feel the effects of a massive increase in rates. There are now considerable uncertainties that the markets will have to address before moving forward. It takes time to digest. In fact, markets typically tend to bottom sometime AFTER the Fed begins to cut rates again. We are not there yet.

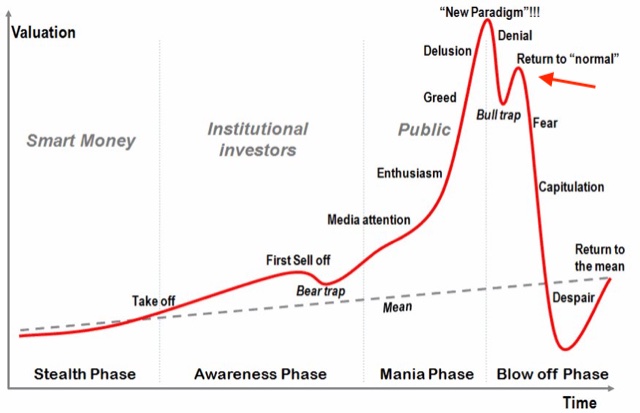

Bull Trap

The markets have been setting up for a traditional Bull Trap for some time now. As you can see on the standard market cycle chart below, we are likely in the “Return to Normal” phase of the cycle. There has not been enough “Fear” and “Capitulation” in this market yet. This doesn’t necessarily mean we are destined to a 50% or more pullback in equity prices. It just means that while the markets are beginning to act like a new bull market is in place, I am thinking within the specter of historical precedents as they relate to the reality of the situation on the ground. That situation includes the aforementioned digesting of higher rates, the strong possibility of negative corporate earnings and GDP remaining negative in Q2.

What We Know

We know that the Federal Reserve is hiking rates into an economic slowdown. Chairman Powell has made it clear that he will bring inflation down to 2%, come hell or high water. He also does not want to stop raising rates too early like they did in the 1980’s cycle. Lastly, we know the Fed is relying on the labor market as a primary signal, a backward looking indicator. It all speaks to the likelihood of the Fed going too high on rates, for too long. Which could be a disaster to economic health in the short term.

We know that the massive speed and magnitude of tightening has not worked its way through the economy. The bank runs on Silicon Valley Bank and others are just the early results of the effects of Fed tightening. We have not seen the labor markets soften enough yet. Nor have we seen prices across the economy moderate enough yet.

We know that GDP will be negative Quarter over Quarter in Q1 and Q2. We know that this will affect earnings with a meaningful slowdown very likely. Bad earnings reports do not bode well for market sentiment.

We know that indexes can rally during a bear market. It happens. The average S&P 500 rally during the 2000 – 2002 bear market was about +13%. The NASDAQ had 11 rallies of more than 10% during the same time. The indexes remain emotionally driven in the short term but destined to show fundamental economic reality in the long term.

Comfort Zone

Noting the above, a simple question to answer is “where do we feel more comfortable?” Within the context of the S&P 500 we can easily see a trend line (represented by the “Mean” line in the chart above) that runs from the 2009 market bottom pretty consistently until the market took off from the 2020 (pandemic) bottom. If we were to come back down to that line the index should (that’s a big should!) retrace down to about 3200 by the end of the year or sometime in 2024. That is 20% lower than where we are today.

I say “should” because there are no guarantees in any of this. Remember, we are all a bunch of humans trying to prescribe our emotional senses to an inanimate object (namely, the market). The market doesn’t care what you or I think and history, while repetitive, can often lead to different outcomes. However, it gives us something to shoot for. Will it be 20 lower%? Could it only be 10% lower? Will it continue higher? Will the Fed step in earlier than expected and stop a falling market? All questions we are searching for answers on.

I would need to see moderation in the economic data before I believed we were “out of the woods”. Prices need to moderate, job openings need to moderate, earnings expectations need to come down. Most importantly, inflation needs to get much closer to that magical 2% before I believe we are in a position to see Fed cuts and the presumption of a new bull market. A lot can happen on the journey between “there” and “here”.

What If We’re Wrong

The ever-standing idea of asset allocation is that one should always have a “balance” in their portfolios. We would all love to be able to know when the market will do one thing or another. However, this is a very difficult thing to do and if you’re wrong it hurts you. So the reasonable tactic in my opinion is to ensure that what you think will happen (continued bear market) won’t hurt you too much while if the opposite thing (a new bull market) happens it doesn’t hurt you too much as well. A tricky task.

Thus, I remain at lower than normal levels of equity allocations within portfolios. This means we have more cash on hand than normal. The cash is invested in short term treasuries earning 3% or more. The plus side of higher rates is one gets paid to wait! Lastly, most portfolios have a decent position in Gold to act as a backstop should the markets get to the “Despair” phase. This all could limit portfolios in the short term as the markets endure these reactionary rallies and portfolios don’t rebound as much. However, if the drawdowns occur because of all the cited points above, portfolios will protect wealth better.

If you have any questions or have experienced any changes in your financial situation please do not hesitate to Contact Me.

We appreciate you being a part of the Shorepine Wealth Management family!

Investment Products are Not FDIC Insured. No Bank Guarantee. May Lose Value. Investing involves risk. All written content on this website is for information purposes only. Opinions expressed herein are solely those of Shorepine Wealth Management, unless otherwise specifically cited. This is neither a solicitation of offers to buy securities nor an offer to sell securities. Past performance is no guarantee of future results. Material shown here is believed to be from reliable sources however, no representations are made by our firm as to another parties’ accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. Shorepine Wealth Management, LLC is a registered investment adviser offering advisory services in the State of California and in other jurisdictions where registered or exempted.