What Did We See?

- U.S. Large Cap stocks, or the S&P 500 index, was up more than 12% in April.

- The developed markets of Japan, Europe and the UK were all up from about 4% to 6%.

- Emerging Markets and Asia (Ex-Japan) were up about 9%.

- Global fixed income returns were all positive while riskier bonds rallied the most.

Where Do We Stand?

- We are experiencing a classic rebound after the damage of February and March.

- Valuations have become a bit less rooted in reality and warrant some correction.

- I remain in a position of avoiding overweights to higher risk equities while maintaining an allocation to quality equities.

- I continue to rebalance your accounts accordingly and have been selectively waiting to put more cash to work in portfolios.

The equity markets took a sentimental journey in April, rebounding sharply from the severe shock of March. While the Coronavirus continued to spread on a global basis, we saw daily infections begin to moderate and the hope for a gradual reopening of economies begin to effect markets. As well, governments and central banks around the world put forth massive stimulus measure to try to mitigate the damage caused by a relative ceasing of most economic activity.

What the global economy will look like coming out of this environment is a point for much debate. The market is acting as if everything will go back to the way it was in February. History would suggest otherwise. Considerable uncertainty remains over the true state of the economy after a shock like this and how long it may take us to return to normal, if we ever do. For certain, societies, economies and markets will overcome the Coronavirus over time. The risk now lies in how long that will take and what the global marketplace will look like afterwards.

What’s Good About This Rally?

The S&P 500 declined about 34% from the top in February to the recent bottom in March. From that bottom through the end of April it was back up about 30%. This move higher was in response to the aforementioned moderation in daily infections and massive stimulus measures enacted around the globe. It is important to realize that a 34% decline and a 30% rebound does not mean the market is down 4%. Percentages can play tricks on the average investors mind. In fact, the S&P 500 is still down about 14% from the recent February high. So, all things considered, the market is down ONLY 14% as we sit here today. A 14% decline in equity prices in the face of a shuttered global economy is not too bad, in my opinion.

What’s Bad About This Rally?

The market is seemingly pricing in an economic situation coming out of this environment that I don’t think is rooted in reality. The valuation of the market is still too high, relative to the economic activity we are likely to see over the next few quarters. The market is acting like the economy is going back to February (full employment, decent growth, etc..) and I just don’t see that. 30+ Million Americans are on unemployment. While most will go right back to work once the economy gradually reopens, there are many who will not. Many small businesses are being lost while larger businesses have used the opportunity to trim workforces, permanently.

What’s Bad About Employment?

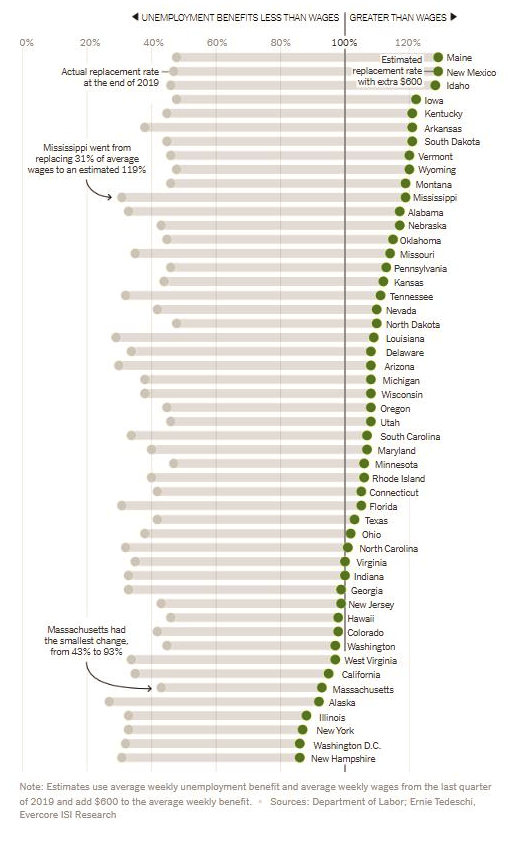

Unemployment benefits may actually out-pay the jobs people are considering going back to. The stimulus bill afforded additional benefits ($600/week) for four months and most benefits overall will last 6 months. So expect some people to take their time getting back to work. Sometime in July would be good estimate for when the unemployed begin to re-engage.

The NY Times ran a nice chart to visualize this reality for many Americans. On a human level this is a good thing. On an economic level it may not be.

What this means is that companies may have to raise wages to get people to return to work, or wait until benefits run out. That means lower earnings or an inability to meet demand, which also means lower earnings. These things take time.

What’s Bad About Earnings?

Right now the market is trading on earnings expectations for the S&P 500 of $150 per share for 2020. The real number is likely going to be $120-$130. Meanwhile, 2021 still has an expectation of $177! If we take the middle point of where I think it will be ($125) for this year and a reasonable P/E ratio of 19x that gets the market to 2375. The index closed the month at about 2912, almost 23% above that level. If we project forward to 2021 and assume we have an earnings rebound back up to $150 by the end of 2021 and apply the same ratio (19x) we can get to 2850. Still higher than it should be and still not very inspiring. Furthermore, if in fact the market is looking past 2020 (as a lost year) I would argue that a valuation multiple of 19x is too high. If the right valuation multiple is 18x the market should be at 2700 (7% lower). If it is 17x it should be at 2550 (12% lower). I think you get the picture.

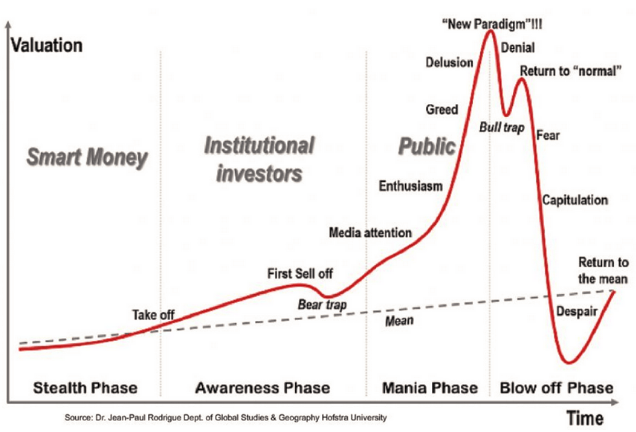

Another dangerous element to this rally is the seemingly textbook “bull trap” that it looks like. Throughout the history of the markets, equities have consistently followed a general pattern. The patterns are never perfect similes from one time to the next but they do have tendencies that are rooted in the fact that human emotions are at play in markets.

The hypothetical picture looks like this:

While the market crash of March was terrible and did have elements of “fear”, one can argue that “capitulation” and “despair” never really fully happened. Again, there is no rule book that says it has to happen. Yet the picture does leave an indelible mark.

What’s Rational?

The rational answer lies somewhere between the “good” and the “bad”, in my opinion.

Do I think we need some “capitulation”? Yes.

Do I think the market chart is going to look like that picture above? Probably not exactly, but it will likely have elements of that hypothetical picture.

There are several reasons why the probability is not in our favor that we will return immediately to the roaring market of February as the market may be suggesting:

1) Employment is not going back to February’s levels quickly, as per the reasons cited above.

2) Earnings will lag for a while, but will recover eventually. It’s what we do as a country. We earn. But, again, it will take time.

3) The U.S. Economy shrunk at 4.8% pace in the first quarter, signaling the start of a recession. This is the first quarterly contraction since 2014 and the biggest since 2008. Even small recessions take time to work off.

What Do We Do?

I would expect more attractive risk/reward opportunities in select asset classes to present themselves in the coming months. Thus, we have reserved some buying power to take advantage when that time comes. We have been decidedly underweight US Small and Mid-Caps, High Yield bonds and International. I believe these areas are going to struggle more with the ongoing recession/earnings shortfalls in Q1 and Q2. In markets such as these, fundamentals don’t have an outsized effect upon individual companies in the short term. Markets in distress tend to trade in groups. Whether it be by market cap, factors (high beta versus low beta, cyclical versus defensive, etc…) or geographic region. This is because government responses (both fiscal and monetary) differ in scope and size from one region to the next. They also differ in their effect upon different asset classes. For example, one country may do a good job of helping larger companies than smaller and vice versa. We are also slightly underweight US Large Cap equities but believe the right companies in the right places can weather this storm.

Getting Back to “Normal”?

Markets don’t often repeat, but they do often rhyme. The key is to maintain a level of investments so as to not miss anything, while still protecting your wealth. As the environment dictates it will be important to resume one’s full asset allocation. That day will come and as the opportunities present themselves I look forward to “getting back to normal”. Stay well, wash your hands and please do contact me to discuss.

If you have any questions or have experienced any changes in your financial situation please do not hesitate to Contact Me.

We appreciate you being a part of the Shorepine Wealth Management family!

Investment Products are Not FDIC Insured. No Bank Guarantee. May Lose Value. Investing involves risk. All written content on this website is for information purposes only. Opinions expressed herein are solely those of Shorepine Wealth Management, unless otherwise specifically cited. This is neither a solicitation of offers to buy securities nor an offer to sell securities. Past performance is no guarantee of future results. Material shown here is believed to be from reliable sources however, no representations are made by our firm as to another parties’ accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. Shorepine Wealth Management, LLC is a registered investment adviser offering advisory services in the State of California and in other jurisdictions where registered or exempted.