[sonaar_audioplayer albums=”1232″][/sonaar_audioplayer]

What Did We See?

- The US equity markets experienced some of their best quarterly gains in many years.

- The Federal Reserve’s abrupt change in tone as well as easing tariff tensions have helped.

- Emerging Markets achieved almost double digit returns for the quarter.

- Japan had the worst returns with the UK doing slightly better but both were still positive.

- Global growth has continued to slow and the US yield curve has signaled more pain to come.

Where Do We Stand?

- We continue to monitor this recession story very closely.

- At some point we may look to de-risk your portfolios slightly.

- The Fed will continue to remain patient but could alter that stance as the environment dictates.

- The yield curve is “weakly” signaling a recession but the economy is on relatively solid footing and the odds of a deep recession remain low.

- We continue to rebalance your accounts accordingly and have been impressed with the power of the asset allocation strategies we employ.

___________________________________________________________________________________________________

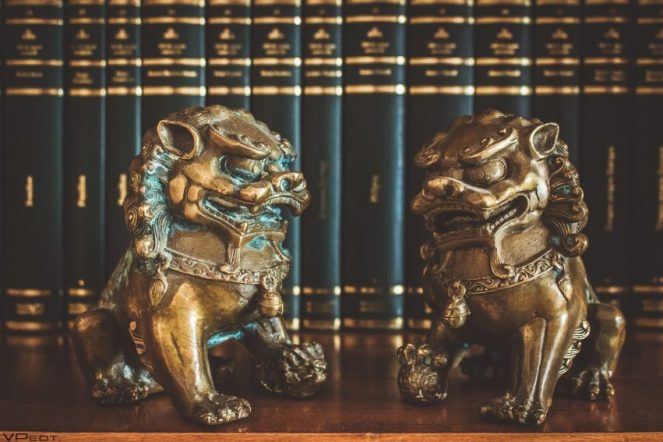

In like a LION…

The first quarter of 2019 brought with it renewed hope for the US equity market mainly driven by a very dovish turn by the Federal Reserve. It also included the official beginning of springtime! The old adage that March “comes in like a lion and goes out like a lamb” could not have been more true this year as it relates to the US equity market. The saying, which some believe dates back to the 17th century, is thought to have originated as an observation of seasonal weather patterns in the Northern Hemisphere. Because March straddles the transition between winter and summer, we often see stormy weather earlier in March with much milder weather in the latter part of the month.

The US equity market saw a very similar pattern in trading during March of this year. US equities rallied for much of the first quarter until early March when the S&P 500 tried to move past the psychologically important 2800 level. Equities pulled back a couple of percent (volatile like a lion) only to renew their rally later (quietly like a lamb) in March. When the quarter was complete, the US market had gained more than 13% to lead all other major global markets. It was a significantly strong return after having struggled through most of the final quarter of 2018.

The weakness we saw in Q4 helped set the stage for a significant rally in Q1. Much of this was driven by the US Federal Reserve which reacted to the weakness in markets and slowing global growth data by taking a more “patient” stance. What this translated to was that the expectation for further rate increases was now gone. In fact, the markets believe the Fed to be so “dovish” (unwilling to raise rates) that the next expected rate move is now a cut in rates. It was a significant change in expectations over a very short period of time.

However, these things do not come without consequences as you will see below.

TIGERS (China / Emerging markets)

One of the consequences of weak global markets was the US administration’s change in course on further tariffs on China. A major risk for global growth over the past several quarters has been the effect of tariffs on the US and China and whether or not the two global superpowers could come to an agreement on trade. Global growth contracted sharply in the second half of 2018 moving from a reasonably strong 4% pace in the first half of the year to a 2-2.5% rate in the second half. Almost half of global growth was wiped out! While still positive, this eased momentum across all the world’s major economies. If the final numbers do indeed show a less than 2.5% growth rate for the second half, the global economy will be growing at a rate not seen since the Great Recession.

Importantly, all is not lost. In fact, many economists believe the worst may already be over. They believe the global slide will bottom out this quarter or next and could rebound nicely in the second half of 2019. If true, the coordinated slowdown of 2019 will be merely a blip on the market’s radar. I think some things need to happen in order for this to be proven out.

First, the US and China will need to agree on a trade deal.

Second, the Fed will have to remain “on pause”.

Lastly, China’s stimulus package will have to be enough to reignite their economy to prior levels.

All three of these things are possible but they are also rather optimistic assumptions.

The yield curve is telling a slightly different story…

YIELD CURVES, OH MY…

One of the other consequences of a much more dovish Federal reserve has been the “inversion” of the yield curve. You may have heard this recently in the news. A yield curve is simply a chart of current interest rates across different bond maturities.

A normal Treasury Yield Curve is depicted here:

As you can see, the longer the maturity, the more the investor gets paid in yield. That is to be expected because one should be compensated more return for “locking up” their money for longer periods of time. When the yield curve inverts it simply means that investors are getting paid more in yield to lend their money for shorter periods of time. The read through on this is that there is more “risk” to lending your money over the next 1, 2 or 3 years. While the yield curve has done a good job of “predicting” an oncoming recession, it has been inconsistent in the timing of such.

Take the 1990’s for example. The yield curve (as described as the difference between the 2Y and 10Y rates) inverted in 1995, 1998 and 1999. Yes, there was a recession after the inversions occurred but that didn’t come until early 2001! If you got out of the markets in 1995 you would have missed one of the largest equity rallies in history. Furthermore, recent research has shown that a better predictor occurs when more parts of the yield curve invert, not just the 2 and 10 year rates. So, by historical standards, the inversion we have experienced is not a very powerful one. Other mitigating factors could be that the US consumer is healthier than previous late cycle environments, global central banks are more coordinated and economic expansions have been getting longer and longer.

“Recession is imminent” is like saying “I will die”. There are truths there to be sure but the length of time it takes to happen is where the real “predictions” can be found. Be wary of prognosticators trying to “time” a recession. They may be right eventually but they also can do irreversible damage to your portfolio. These are the same people that have been promoting their ability to foresee economic events for the past 10 years. They claim that they “predicted” the recession in 2008 our they “found” Amazon when it was a $5 stock. What they won’t tell you is that they’ve been predicting another recession since 2010. If you were out of US Stocks the last 10 years you would have missed one of the best rallies of all time.

Just remember, every economic cycle since the dawn of time has ended with a recession just like every earth based life-form since the dawn of time has ended with a death. It’ll happen, we just don’t know exactly when.

Where do we stand at Shorepine Wealth Management?

We continue to monitor this recession story very closely.

While we would hate to have our clients miss any returns, we are also keenly cognizant of the need to protect our clients from losses. This means that at some point we may look to “de-risk” your portfolios slightly. This would not be any wholesale changes as we are true believers in the power of asset allocation. If a client is in the correct asset allocation strategy they should be able to psychologically manage volatility because their losses are mitigated by their allocation strategy.

Furthermore, we see no signs yet that the recession is imminent. In fact, some of the data points we follow are improving.

Lastly, do not fall into the trap of thinking every recession is like 2008-2009. Take this example. The US was in a recession from July 1990 through March 1991 (only 10 Months!). The S&P 500 lost about 18% through the latter part of 1990 and had recovered it all by February of 1991. It then went on to achieve one of it’s greatest rallies of all time. That would have been terrible to miss because you were trying to avoid a loss.

If you have any questions or have experienced any changes in your financial situation please do not hesitate to contact me.

We appreciate your being a part of the Shorepine Wealth Management family and wish you all the best!

Investment Products are Not FDIC Insured. No Bank Guarantee. May Lose Value. Investing involves risk. All written content on this website is for information purposes only. Opinions expressed herein are solely those of Shorepine Wealth Management, unless otherwise specifically cited. This is neither a solicitation of offers to buy securities nor an offer to sell securities. Past performance is no guarantee of future results. Material shown here is believed to be from reliable sources however, no representations are made by our firm as to another parties’ accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. Shorepine Wealth Management, LLC is a registered investment adviser offering advisory services in the State of California and in other jurisdictions where exempted.