What Did We See?

- U.S. Large Cap stocks, or the S&P 500 index, were up about 2.4% in Q4, 25% in 2024.

- The developed market of Japan was up about 5.4%.

- Europe and the U.K. were down about 3.6% and about 0.4% respectively.

- Emerging Markets and Asia (Ex-Japan) were down about 7.8% and 7.4% respectively.

- Global fixed income returns ended the quarter mixed from +1.7% (Europe) to -6.7% (Global Inflation-Linked).

Where Do We Stand?

- The market rally advanced a bit further in Q4 on the results of the US Presidential Election.

- Valuations still remain elevated versus historic averages with earnings growth needed to support further gains.

- The markets will likely now trade upon any policy decisions made in the beginning of the next administration.

- We remain in a position to weather any volatility with client holdings in Gold and Cash while looking to be more active in opportunities when they present themselves.

Here in San Francisco we have a nickname for our beloved fog. We call it “Karl the Fog”. Karl is a symbol of the city’s resilience and adaptive nature. The name is a reference to the giant in the 2003 film Big Fish. In the film, Karl the giant is a misunderstood character. While everyone is afraid of Karl it turns out he is just a big, hungry, lonely tall person. Not much to worry about. Just something that needs to be understood.

Ch, Ch, Ch, Changes…

Much like Karl the Fog, there is a fog around the upcoming political change that 2025 will bring. While the investing public have been given some inclination as to what changes are coming, no one knows which ones will be implemented and what those changes actually will do. Will the threat of tariffs be enacted? Will they wreak havoc on the prices of goods and services? Are they just simply a threat that is being used to implement other global policy changes? Many questions, little answers as we head into the new year. Markets prefer answers.

Beware the Forecasts

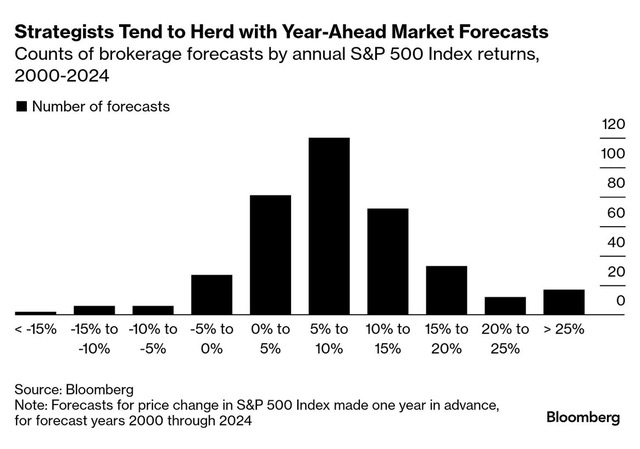

One way to get a “potential” answer is through predictions. At the end of every year all of your favorite market prognosticators come out with their prediction asa to what the markets will do in the coming year. As you can see on the chart from Bloomberg below, strategists tend to herd around an easily digestible return expectation for the year. This year is no different, with the majority of forecasts falling in the 5% – 10% range.

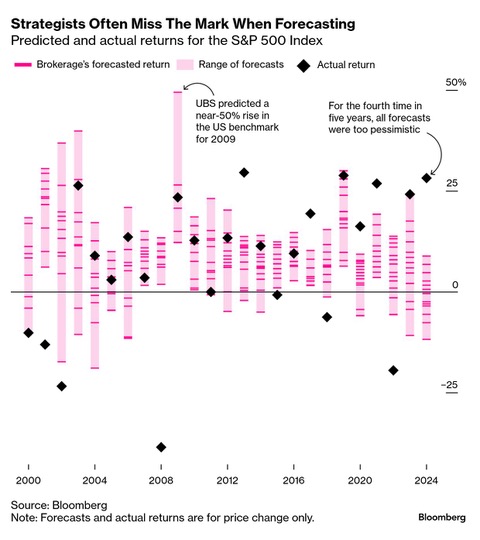

However, I would warn you that these are mostly always wrong. As one can see below, over the past 25 years the predictions were too optimistic nine times, too pessimistic twelve times and pretty close only 4 times. Even more alarming is the fact that for eleven of those years the actual return didn’t even fall into the range of predictions. That means almost half the time, all the forecasters are completely wrong. Keep that in mind as you read the financial news over Q1.

Answers

The answers to many of our questions will be revealed through the passage of time. How long this policy uncertainty will last will be a factor of the administration and how quickly they may or may not implement their plans. From raising tariffs to deportation policies to lowering taxes and loosening regulations. It is difficult to say whether some or all of these goals will be implemented and how long they will take to be effected. One can be sure the Democratic caucus will be there blocking the door on all these goals. These are certainly areas to watch closely.

Inflation

Inflation is another area to watch closely. While we have seen some easing in inflation over 2024 in some areas, other areas bear watching. Policy on trade, supply chain disruptions due to tariffs and labor constraints could easily re-ignite the inflation problems we are just coming out of. A re-introduction of high inflation would force the Fed to pause all rate cuts for 2025 and certainly have a dampening effect on the euphoria of markets.

Valuations

The S&P 500 now sits at a Forward Price to Earnings ratio of about 22 times. The last time it was this high was during the pandemic-fueled rally and the only time before that it was this high was right before the 2000 market crash. That doesn’t mean we are due for a crash. It simply lets us know that either earnings (the denominator in P/E) need to continue to grow or else the P (Price) is going to go down. Can earnings grow through all of the policy fog and prospective changes coming in 2025? Some companies will, some may not.

Recent Action

The market has been dropping lately for primarily two reasons. The Federal Reserve is one and Trump is the other. During the December Federal Reserve meeting the committee reduced the number of expected rate cuts in 2025 from four to just two. This, in conjunction with language changes around their commentary has led many investors to believe that the fed may be actually done with rate cuts for now. This has made the markets very sensitive to any data that does not give the Fed fuel to continue cutting rates. If the job market remains strong and inflation factors do not recede, the markets will continue to show weakness at times.

The second factor is President-Elect Trump. The volatility in headlines around tariffs, failed nominations, government shutdowns and potential seizures of canals and countries has undermined the post-election confidence that drove markets higher in November. Renewed inflation concerns did little to help.

Conclusions

In conclusion, the market had another very strong year and a decent fourth quarter. One may question whether this is repeatable for a third year or whether or not the drivers of said perforce will be the same (Mega Cap Tech, AI, etc…) or something else entirely.

Certainly, the US can continue to outperform on an economic basis as the rest of the world catches up to our lead in Tech and AI amongst other areas. However, with very high valuations, policy uncertainty, inflation still in play and high interest rates the expectations may be leaning towards too optimistic. Hopefully, the fog will clear early in 2025.

If you have any questions or have experienced any changes in your financial situation please do not hesitate to Contact Me.

We appreciate you being a part of the Shorepine Wealth Management family!

Investment Products are Not FDIC Insured. No Bank Guarantee. May Lose Value. Investing involves risk. All written content on this website is for information purposes only. Opinions expressed herein are solely those of Shorepine Wealth Management, unless otherwise specifically cited. This is neither a solicitation of offers to buy securities nor an offer to sell securities. Past performance is no guarantee of future results. Material shown here is believed to be from reliable sources however, no representations are made by our firm as to another parties’ accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation. Shorepine Wealth Management, LLC is a registered investment adviser offering advisory services in the State of California and in other jurisdictions where registered or exempted.