Investment Management

The two largest detriments to a successful investment outcome are fees and taxes.

- We strive to manage your portfolios in the most tax efficient manner possible relative to your unique circumstances.

- We look to reduce trading costs by investing for the long term while avoiding high cost investment vehicles.

- We believe that a proper portfolio provides growth in good markets, protection in difficult markets and can adapt to changing economic cycles.

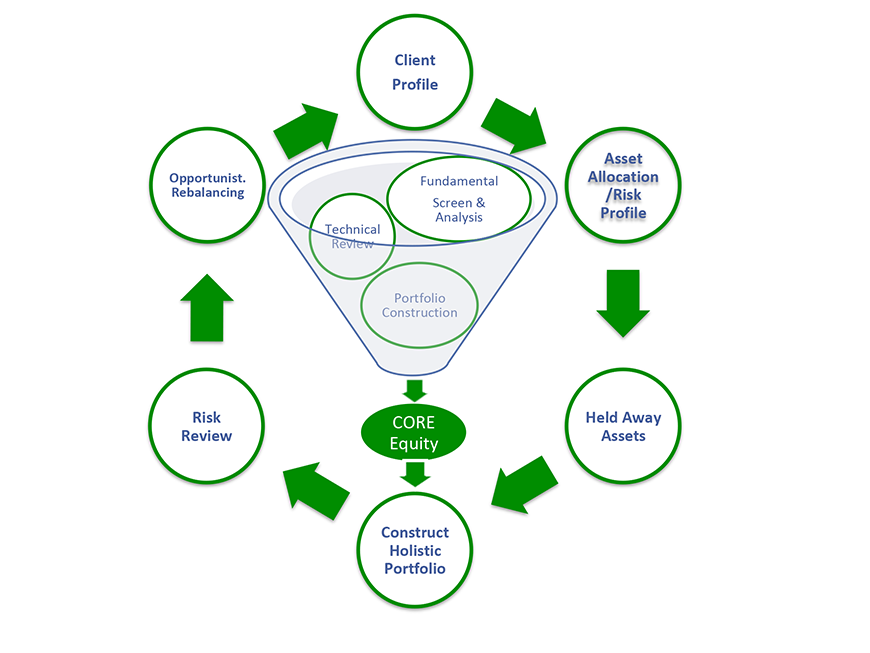

We employ a comprehensive and ongoing investment management process for all of our clients.

- Our process is rooted in an evidence-based investment management philosophy.

- We look to reduce costs and taxes wherever and whenever possible.

- Why? Because it’s the money you earn and KEEP that matters most in investing.

We begin by building and managing a US based Large Cap Equity portfolio for all of our clients.

- This portfolio consists of 100% US equity holdings that exhibit characteristics that tend to outperform over time.

- These are well established companies with strong cash flows, low debt structures and defendable business models trading at reasonable valuations.

- We incorporate both fundamental and technical analysis tools in our work because evidence suggests that it is just as important to know WHY you own a stock as it is to know WHEN to buy (or sell) it.

- We buy and hold companies for longer time horizons and thus, keep turnover (and taxes) to a minimum.

- Lastly, risk is controlled at the security level via these same fundamental and technical factors, and at the sector level via our weight guidelines.

We then extensively profile you, the client, to help determine the right mix of assets to hold.

- This profile will help us determine your household’s risk tolerances which helps us dictate the right level of risk for you to take in your portfolio.

- In this profile we will also incorporate any “held away” assets such as income-producing real estate or other holdings.

- We do all this because of the holistic nature of our process (For example, it does not make sense to add Real Estate to your investment portfolios if a large portion of your net worth is already allocated to Real Estate investments elsewhere).

We then surround the core portfolio with uncorrelated assets that are weighted according to your risk profile.

- Uncorrelated assets can provide diversification and return benefits.

- Portfolios adhere to an “Opportunistic Rebalancing” approach that has been shown to positively impact long term returns. (See Below)

This results in a “Total Portfolio” that is uniquely designed to your needs, risk tolerances and circumstances and consistently managed to those factors.

We repeat this process on an ongoing basis and we update your profile at least annually or as life events dictate.

Our portfolios are consistently monitored for rebalancing opportunities that can further enhance returns.

- Studies have shown that the best results come from “Opportunistic Rebalancing”. This is a newer approach to the traditional rebalancing that many wealth managers have used.

- Instead of rebalancing on a set date or time period (i.e.: annually, quarterly, etc..), our approach is to look at our client’s portfolios at least 3 times a week for rebalancing opportunities.

- By incorporating powerful rebalancing technologies we can consistently monitor your portfolio. When any one asset class exceeds our tolerance bands, we will selectively rebalance those securities or assets back towards their correct asset allocation.

- In 2008, Gobind Daryanani, Ph.D. showed that “by looking frequently but rebalancing only when needed, the average rebalancing benefits are shown to be more than double the benefits of more traditional annual rebalancing.”*

* Journal of Financial Planning, January 2008, “Opportunistic Rebalancing: A New Paradigm for Wealth Managers”, Daryanani, Gobind

Learn more about our Investment Management

All Services

Unbiased advice for Individuals, Foundations and Endowments